Global oil market

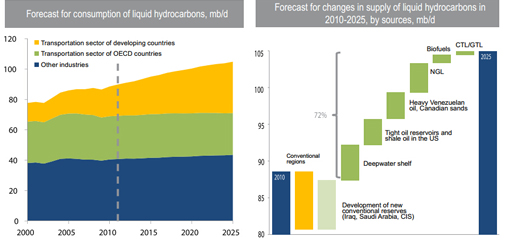

Demand for liquid hydrocarbons will continue to grow. Global demand for liquid hydrocarbons will continue to grow annually by 1.2% on average and will, in Lukoil's estimate, reach 105 mb/d by 2025. Despite stable growth rates, oil's share in the global consumption of energy resources will gradually decrease, because of substitution for other energy sources in such sectors as power generation and housing. The greatest surge in oil demand will come from the transportation sector, for which oil is the principal energy source (over 90%).

From 2010-2025 over 70% of the increase in the supply of liquid hydrocarbons will come from the use of hi-tech production methods and alternative fuels such as natural gas liquids (NGL), GTL/CTL and biofuel.

For the next decade North America will remain the leader in terms of growth of production of liquid hydrocarbons. By 2025 the aggregate volume of liquid hydrocarbon and biofuel production in the US and Canada will amount to 19 mb/d, Iraq remains the most promising region in terms of conventional oil production growth. Lukoil forecast that by 2020 oil production in Iraq will reach 6 mb/d. OPEC members will limit the growth of their own production, thus supporting the global oil prices at necessary levels.

Global gas market

Gas demand drivers

Key growth factors in the demand for gas were its environmental credentials and low costs in comparison with other types of fossil fuels. Another growth driver for gas-fired generation is the worldwide concern about the safety and reliability of the nuclear power. population growth will also contribute to the growth in gas consumption in the residential and industrial sectors.

Lukoil estimate, that until 2025 global gas consumption will continue to grow at an annual rate of 2.2%. Therefore gas consumption will have the highest rate of growth among other types of fossil fuels.

Regional Forecast

Chinese gas consumption may reach 200-250 bcm as early as 2015. The growth of gas consumption in China will considerably exceed domestic production, thus creating opportunities for export to this country. Despite the forecasted high growth rate of global gas consumption, demand for gas in Europe is unlikely to grow significantly in the next 5-10 years. European coal market prices have fallen due to the glut. As a result, coal became more economically efficient than natural gas for power generation in Europe. Low rates of economic growth do not favor growth in European gas consumption unlike the fast-growing gas markets of Asia and the Middle East.

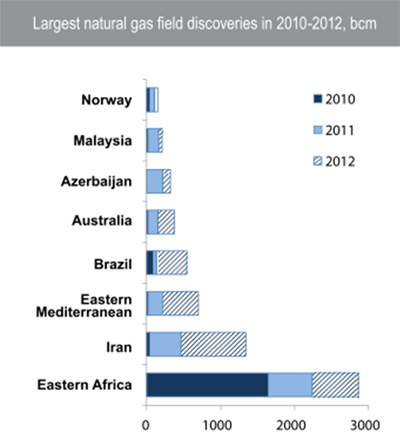

Very soon South-East Africa and the Eastern Mediterranean will become global sources of gas supply. Total annual export capability of South-East Africa is estimated around 70 mmpta, putting the region's export potential on par with the US. To minimize costs, Chinese and Indian oil and gas companies are acquiring stakes in production projects around the region.

|