Advances in telecom technologies continue to create significant business opportunities, even spawning entirely new business models. The fourth generation of cellular wireless standards (4G), the movement toward open mobile and the increasing proliferation of mobile Internet devices are transforming the telecommunications ecosystem.

Telecommunications operators are facing the challenges of growth, convergence, business transformation, technological change and regulatory pressures in increasingly difficult economic conditions. It's no secret that the world's wireline and wireless service providers, telecom equipment vendors and Internet players face major challenges. While new market entries and IPOs reshaped the competitive landscape during the dot-com era, major bankruptcies and reorganizations are having an equally profound impact today.

Despite continued double-digit growth in the demand for data services, most carriers are seeing their prices pushed downward by competition and overcapacity. Meanwhile, innovations such as video on demand, IP applications, and 3G wireless services have yet to meet investors' high expectations for growth.

Asia’s market size, geographical diversity and divergent market dynamism are creating test beds for the technical standards and business cases for BWA (Broadband Wireless Access). The developments in Asia will likely provide key indicators and, in some cases, the necessary volume or carrier innovation for global adoption. According to TRPC, one sixth of the world’s mobile phones are in China and India alone. If China continues to favour its own 3G (and future 4G) standard over WiMAX this could tip the balance for the future of BWA while India’s stance on 3G technology adoption also has great potential to impact market dynamics.

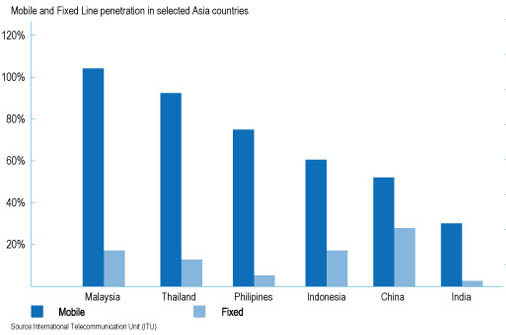

Japan and South Korea have been two of the world's most advanced mobile and broadband markets while Taiwan has been championing WiMAX as an industrial policy issue. WiMAX has also been most advanced in Malaysia while this technology choice may also prove an ideal substitute for fixed broadband in other emerging markets such as archipelago Indonesia or the Philippines. Industry estimates also show that Asia will soon be the top region for BWA video consumption and, by 2017, this region is predicted to generate over half (53%) of all traffic, followed by Europe (26%) and North America (14%). These estimates can be explained by the fact that wireless broadband has been the widely chosen option for broadband connectivity across many of the Asia Pacific countries.

We bring together people and ideas from across the world, to help our clients address the challenges of today — and tomorrow. Our clients benefit from our insights on key trends and emerging issues — whether relating to the economic downturn, next-generation services, infrastructure sharing, outsourcing, operational efficiency, regulations, future growth markets or mergers and acquisitions. Only in this way can they react to trends in a way that improves the financial performance of their business. |