Unconventional resources—specifically shale gas, tight gas, shale oil and tight oil—haverevolutionized the energy landscape in the US, using new technologies such as horizontaldrilling and hydraulic fracturing to access previously unavailable reserves. America's successwith unconventional resources hit the world. Unconventional gas is seen as a relatively clean source of energy and as presenting an opportunity for enhanced energy security and diversity of supply.

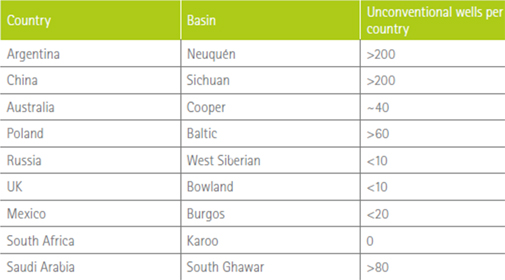

Recent estimates point to the large potential for unconventional gas, especially the shale gas are mainly in a growing list of countries, including South Africa, Mexico,

Brazil, China, Algeria and the Ukraine, Poland, UK and Australia, among which Argentina and China have championed active exploration as the above picture describes.

China is undeniably an up-and-coming player and, with strong government backing, is likely to have a strong influence on global markets within the next five years, and should continue to prove attractive to overseas investors.

In Argentina, the fiscal regime is themost important factor driving pace ofdevelopment. Similarly, Poland could increaseits activity to the Baltic Basin with the helpof pending changes to its fiscal regime.USsentiment towards Russia could change, accelerating investment into Russia.

In Australia and Mexico, the level ofcompetition for investment and humanresources from conventionals or otherresources such as CBM in Australia andshallow water/offshore investment inMexico will have the greatest effect onthe pace of developing unconventionalresources operations.

In the UK, NGO opposition tounconventionals is the key factor affectingthe pace of development.

South Africa is still in the very early stagesof development, making it difficult to singleout a lone factor affecting the pace ofdevelopment there.

Algeria plans to begin shale gas production by 2022, and by 2025, they want to achieve a production level of about 10 billion cubic meter of shale gas.

In Saudi Arabia, lack of knowledge on its shale formation andlack of infrastructure and water to supportlarge-scale development in some frontierlocations are among the biggest challengesfor local shale development

|