The collapse of the housing bubble, which peaked in the U.S. in 2006, caused the values of securities tied to real estate pricing to plummet thereafter, damaging financial institutions globally. Questions regarding bank solvency, declines in credit availability, and damaged investor confidence had an impact on global stock markets, where securities suffered large losses during late 2008 and early 2009. Economies worldwide slowed during this period as credit tightened and international trade declined. Critics argued that credit rating agencies and investors failed to accurately price the risk involved with mortgage-related financial products, and that governments did not adjust their regulatory practices to address 21st century financial markets. Governments and central banks responded with unprecedented fiscal stimulus, monetary policyexpansion, and institutional bailouts.

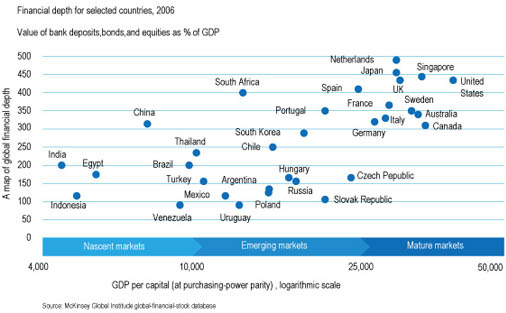

Several trends that look set to continue during the years ahead, long after the present bout of market turbulence has ended:- the continued growth and deepening of global capital markets as investors pour more money into equities, debt securities, bank deposits, and other assets around the world

- the soaring growth of financial markets in emerging economies and the growing ties between financial markets in developed and developing countries

- the shift of financial weight in Asia from Japan toward China and other fast-growing emerging markets

Successful synthetic consulting company recognise that greater transparency and clear explanation of the rationale for business strategies will be critical in boosting market confidence and securing access to limited capital in the wake of the financial crisis. Crucial considerations include effective explanation of the risk profile and the underlying strategy and implications. Smart firms are therefore looking beyond basic compliance to provide real insights into the appetite for risk, the priorities and assumptions governing risk management and how risk influences key business decisions.

We are also looking closely at how to influence and respond to planned changes in market reporting to ensure they reflect the realities of their business and provide more relevant and reliable information for analysts and investors.

The problems below are in our consideration:- How can financial institutions develop a more integrated, enterprise-wide approach to managing risk and data across the enterprise?

- What are the channels, products, and services that can generate customer loyalty and a distinctive experience?

- What will be the new products or operating models for investment banking, asset management, and wealth management activities?

- Helping the financial services industry understand and address emerging opportunities in risk and information technology, regulatory compliance, growth, and cost management.

Additionally, we are continuing to provide report, executive dialogues and industry benchmarking on current trends and critical issues for banking and securities organizations. An expanded mission is to offer more holistic, financial services industry viewpoints that also deliver value to the insurance, private equity, hedge fund, mutual fund, and real estate sectors. The final achievement is to deliver tailored solutions to help our clients address today’s challenges, maximize market opportunities, and create competitive advantage. Through the effective solution for knowledge sharing, it enables us to anticipate trends and their implications for our clients. |