|

|

| Real Estate |

| |

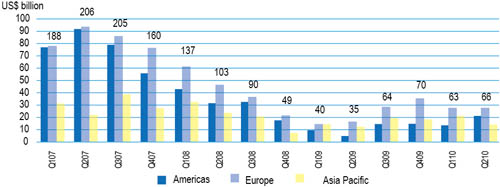

Global commercial real estate (CRE) investment has been recovering since the second half of 2009 and is expected to reach US$300 billion by the end of 2010, a 40–50 percent year-on-year increase. Geographically, Americas outpaced Europe Middle East and Africa (EMEA) and Asia-Pacific in terms of improvement in CRE investment — although, its base was the lowest among the other regions. The recovery is driven by improved global liquidity and credit conditions, coupled with investor confidence, which has provided an impetus to cross-border investments. However, the risks associated with the scale of maturing debt in the US and the UK over the coming years loom ominously beside the tight credit for non-trophy assets and the lack of quality investments for a sustained recovery.

Improvement in the global economy has seemingly filtered through to real estate, which observed improved CRE investments in the second half of 2009 after the 70 percent plummet from 2007 levels. This recovery in CRE investments continued through the first half of 2010, with investments doubling year-on-year, as illustrated in this figure. |

|

| |

|

| 2009 |

2010 |

n the first half of 2010, global CRE investments rose four

percent quarter-on-quarter (q-o-q) and 89 percent y-o-y.

However, volumes are well below pre-crisis levels, and the growth has slowed since the third quarter of 2009. |

Investment in the second half of 2009 improved 79 percent over the first half.

Overall, 2009 investment levels were down 45 percent from 2009. |

|

Although the investment for real estate is increasing, this industry is still a hard market to read. When — and where — does an astute company take the plunge into the commercial property market? Issues of timing and location often can be as crucial as the amount of capital earmarked for such a transition.

Following sharp declines and painful deleveraging in the wake of financial and economic turmoil, commercial real estate (CRE) is showing signs that the deterioration of industry transactions and fundamentals has begun to plateau, and that early stages of recovery may be imminent. Despite some encouraging activity, however, impediments such as looming debt maturities and high unemployment rates are causing uncertainty, dimming prospects of a robust, short-term rebound.

The top 10 issues for the commercial real estate in 2011, including:- Current state of CRE: Prevailing uncertainty, as downturn defies expectations

- Lender lenience: Impact of “amend and extend”

- Looming debt: High maturities remain a challenge

- Deal flow: Distress fuels modest revival in transactions

- Economy: Trajectory of economic fundamentals remains uncertain

- CRE fundamentals: Fundamentals moderating, but recovery may be slow

- Real Estate Investment Trusts: REIT rebound continues

- Capital markets: Lending stabilizes; demand subdued

- Regulation: Direct and indirect impact of regulation on CRE

- Globalization: Positive signs for global CRE

Our Global Real Estate Team gives our clients an international perspective on the industry, and facilitates the collaboration that helps you solve your business issues and achieve your potential. Our extensive network of dedicated professionals offers entrepreneurial thinking and deep technical experience. |

| |

|

|

|